Entrepreneurs’ single tax is to be raised by 40%

- 9.01.2014, 13:42

- 2,952

Experts studied suggestions by officials to raise duties collected from the capital’s individual entrepreneurs.

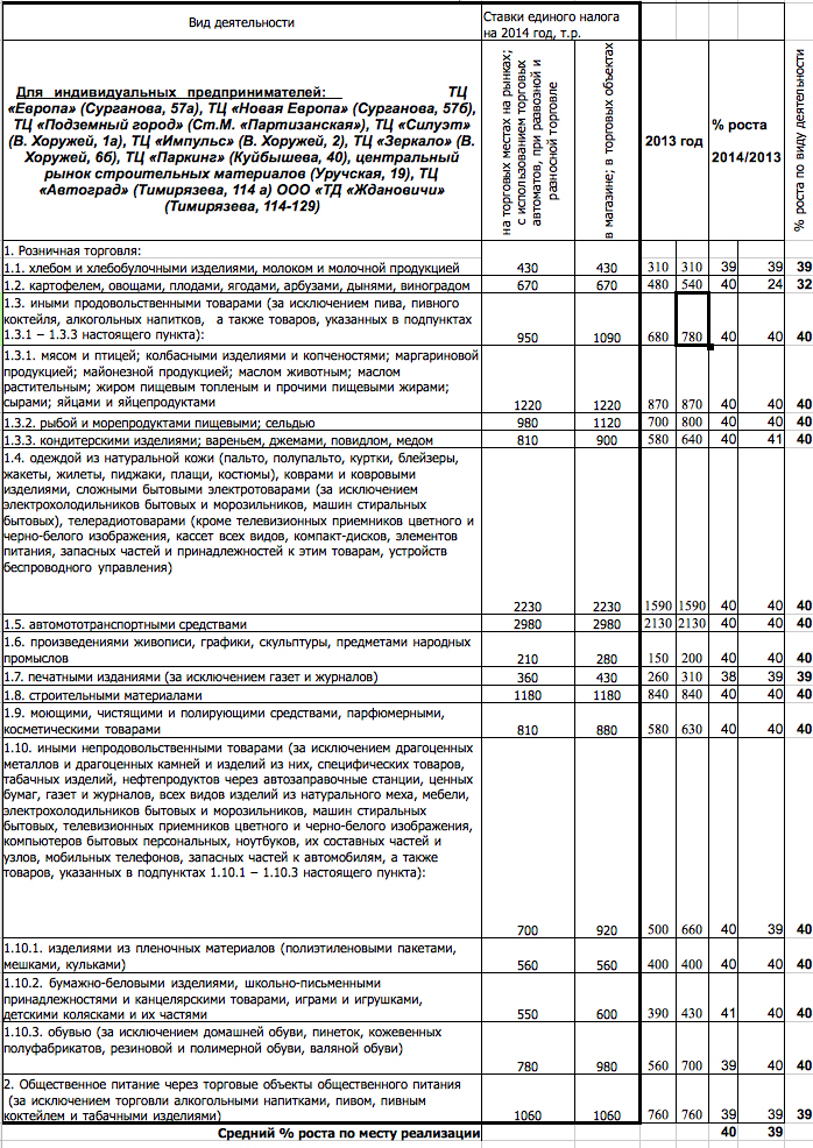

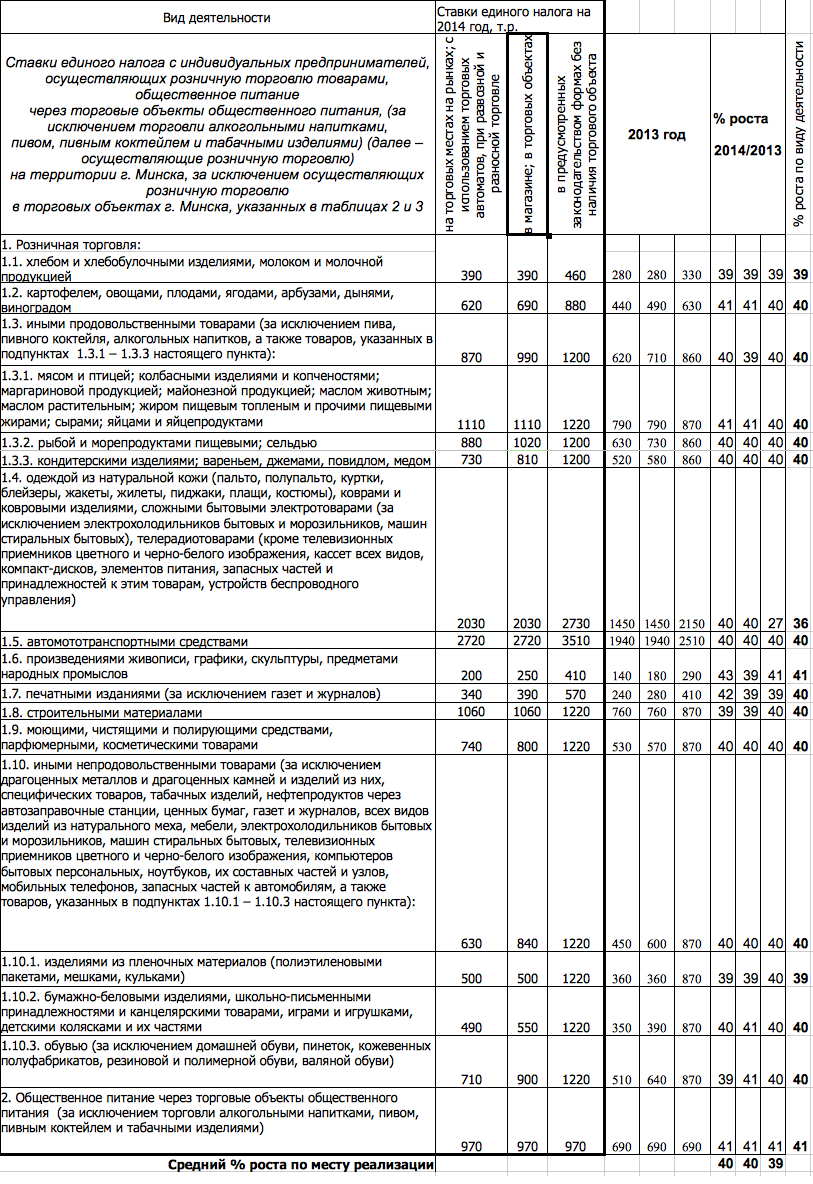

In the case the new rates are approved by parliamentarians, the single tax, that Minsk entrepreneurs will have to pay, will grow by 24-41%. The charter97.org web-site learnt about that from Perspectiva organization. The organization’s experts compared the 2013 single tax rate with Minsk city executive committee’s suggestions.

According to them, entrepreneurs working in the trading centers Europe, Underground City, Silhouette, Impulse, Mirror, Parking as well as in the builders’ market in Uruchcha and the market in Zhanovichy will have to pay 39-40% more. For the entrepreneurs operating in the markets Svelta, Chyzhouski, Kurasoushchynski, Oktiabrski, Velozavodskoj, Uruchcha-3 and Uralskij the tax increase will account for 24-41%.

“We deem the tax rate increase by 40% extreme and ungrounded, - they claim at Perspectiva. – It was supposed that the recalculation of entrepreneurs’ obligatory payments would be linked to the inflation rate, consumer price index, but this is not happening.

In reality, according to the resolution by the Council of Ministers of the Republic of Belarus as of 13.03.2013 number 172, the basic rent unit was set at the level of 86000 starting from 1 April 2013. Compared to the previous rate, established on 1 April 2012 at the level of 54000, it grew by over 59%, while the inflation in 2012 was 21.8%”.

Entrepreneurs emphasize that this is not a particular case, but a system, in the basis of which there is a policy implemented by the state in relation to small and medium business.

“Thus, based on the findings and methods, suggested by us, we deem it possible to establish a limitation on the raise of single tax for individual entrepreneurs of Minsk at the level of not more 10-12% instead of the suggested 28-40%”, - they claimed at Perspectiva.

We would remind that the draft resolution suggests to introduce new higher rates of the income tax for natural persons instead of the rates, established in 2013.

In particular, the single tax for natural persons, not registered as individual entrepreneurs, and for giving private lessons will amount to 170 thousand Belarusian roubles instead of the previous 120 thousand Belarusian roubles; for musical services at weddings, jubilees and other festivities – 770 thousand Belarusian roubles instead of 440 thousand Belarusian roubles like before.

It is also suggested to accordingly change the single tax rates for individual entrepreneurs, working in retail trade, public catering and providing services.

The current single tax rates for individual entrepreneurs and other natural persons were established in accordance with the resolution by Minsk City Council number 292 as of 28 December 2012 within the limits, provided by the basic rates in accordance with the Tax Code of the Republic of Belarus.