How Much Money The Government Takes From The Belarusians

69- 15.09.2016, 10:00

- 21,060

The authorities try to hide from us ways of treasury reimbursement.

And the state, as well as everyone of us, has its own purse - the state budget. It consists of taxes, fines, duties and other payments paid by citizens, Zautra Tvaye Krainy writes.

And the notorious VAT

In the first half of 2016 the revenue of the Belarusian consolidated budget amounted to 13.46 billion denominated rubles. It is about 1400 rubles per each inhabitant of the country, or almost 3000 rubles for each employee in our economy. By the way, this is the third part of the country's GDP.

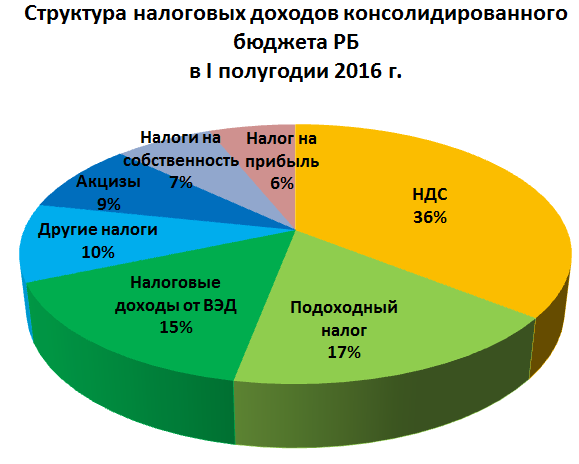

83.2% of this amount is generated by taxes. If you think that it is mainly taxes paid by large businesses, then you are sadly at fault. The share of profit tax in the total tax revenues of the consolidated budget amounted to only 6%. But the share of income tax which is deducted from wages of ordinary citizens has reached 17%. This is the second most important tax for the budget. Only value-added tax is more significant; its share in Belarus' GDP is 36%.

Who do you think are those who pay it? Now it equals to 20%. Yes, you are - and you pay it every time when you go shopping. The VAT is an indirect tax in the price of goods. A buyer pays VAT to a seller, who, in his turn, gives it to the budget. Some goods have no VAT, but this is the exception rather than the rule. It turns out that if you buy products valued at 120 rubles, 20 rubles are VAT.

It is impossible to find out how much someone paid for something

But this is not the end. When buying imported goods, you pay the import duty. And if you buy cigarettes, alcohol or motor fuel, you will pay the excise tax. For example, the price of a liter of beer is included in the excise duty in the amount of 35 kopecks, and in each pack of cigarettes - from 30 to 78 kopecks depending on the brand and the season, in a liter of gasoline of Euro-5 - 23 kopecks. In the first six months of 2016 the state raised 970 million denominated rubles on excise duties.

By the way, any company knows that it has to pay the profit tax. These costs are included in prices and are the problem of consumers. It looks like the situation of cross-subsidization of utilities: legal entities allegedly pay more, but in fact they include their expenditures in goods and services, and the major payer is an ordinary citizen. In addition, the scheme itself is complicated and puzzling, and it is impossible to figure out who has paid and how much

It is impossible to find the accurate number of taxes paid by a Belarusian. It depends not only deduction of taxes, but on his consumption field. But let's still try to make a rough calculation for a family of two people with "net" aggregate salary of 1.500 rubles. Let us assume that per month the family smokes 30 packs of cigarettes, drinks 10 liters of beer, buys 100 liters of gasoline of Euro-5 and spends 1.200 rubles on goods and services including VAT.

By the most conservative estimate taxes equal to 500 rubles (224 income tax, 200 - VAT, and 50 rubles - excise duties). And this is not the end, but more or less transparent situation. And if you think that due to these taxes the state will then pay you a pension, then you are wrong. Contributions to the Social Protection Fund is a different story, and our family with an income of 1 500 rubles this campaign costs around 600 rubles. An employer pays it. This means that such family actually earns more than 2300 rubles. But a considerable part the state takes away at once, and the rest is taken little by little.

A hundred thousand different "why"

So, more than half of all salaries the state owns to ensure social protection and a comfortable life. All this, in principle, is right, and there is the same situation in most countries. The only nuance is that Belarusians do not realize how much taxes they actually pay.

No one talks about it.

Why? Because the real amount of payments to the budget will cause many unpleasant questions.

Why do we have to go to private medical centers?

Why should we constantly pay in schools and nursery schools?

Why is it so difficult to get a pool membership?

Why does the road destroyed by Belarusian tanks after the military parade-2016 still look poor?

And there are a hundred thousand different "why".

Meanwhile, these questions, unfortunately, have no answer.