Lukashenka's Economy Given Sentence

38- 5.12.2016, 8:44

- 24,852

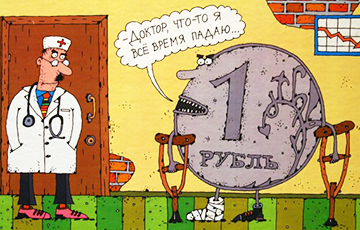

Experts refute optimistic statements of bureaucrats.

Qualitative growth indicators, labour efficiency and return of capital continue to decline causing doubts in the "internal readiness" of the economy to recover.

Experts of BEROC note that in a quarter review of the Belarusian economy.

Despite the decline in inflation (9.2% in the first ten months), experts pay attention to the preservation of the "monetary overhang". "Low confidence in the monetary (and economic) policy, caused by the large-scale financial disturbances in the past and the structural weakness of the national economy (i.e. doubts in its ability to generate growth), stipulate stability of the "monetary overhang" - expectations are systematically higher than actual inflation. In the third quarter inflation expectations declined, but causing the preservation of "overhang" in proportion to inflation," thinktanks.by quotes the review.

The current state of the monetary policy is specified with passivity and "forced rigidity", experts say.

"Referring to lack of authority, the National Bank is not trying to actively fight "monetary overhang"(i.e. affecting expectations). Therefore, contrary to rational desire to provide a stimulating effect, it is forced to maintain a strict policy focusing on threats to financial stability, but slowing down the economic rebound", the study points out.

Analyzing the fiscal policy, BEROC also draws attention to passiveness and forced procyclicality. According to experts, in relative terms growing payments burden and debt service determine the versatility and forced rigidity of fiscal policy. To fulfill its commitments the government has to maintain consolidated budget surplus. In particular, in January-October the budget surplus in the government sector equaled to 3.1% of GDP.

Despite the relative stability of income as a percentage of GDP, in real terms it reduces against the backdrop of the recession. "It stipulates even more proportional reduction in costs, whereas the current macroeconomic situation has prerequisites for fiscal stimulus," the authors of the study believe.

The increase of the public debt forming up the ground for future fiscal and financial turbulence is another problem.

The external debt is increasing as well. "Despite the stability of an absolute value of the gross external debt, the debt burden maintain growth due to large-scale shortage of GDP in dollar terms. It poses the threat that the restraining influence of indebtedness on business activity will progress," experts conclude.